how much taxes are taken out of paycheck in michigan

Newest Checking Account Bonuses and Promotions. This rate applies to both single and.

Michigan Salary Calculator 2022 Icalculator

Local income tax ranging from 1 to 24.

. If you had federal taxes withheld from your unemployment benefits throughout the year its possible the new 10200 exemption will make you eligible for a refund. Overview of Michigan Taxes. Examples of legally authorized deductions are.

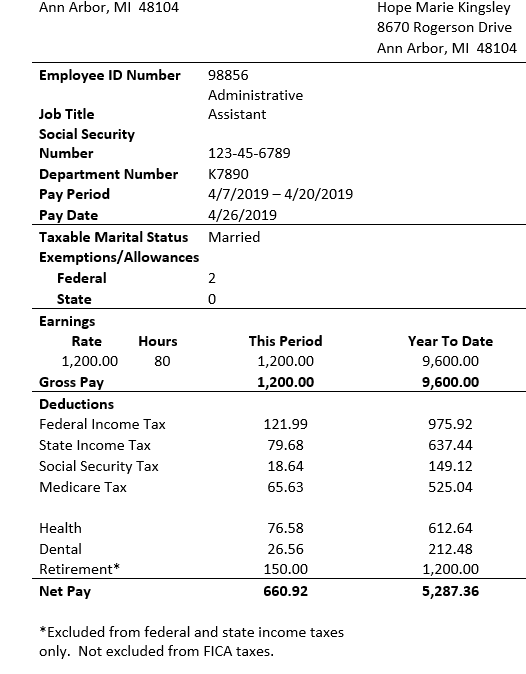

The next 30249 you earn--the amount from 9876 to 40125-. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of 425. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. At the same time Michigan increased its personal exemption. I believe they accidentally hit an extra 0 when inputting the value.

Total income taxes paid. The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim. Use this paycheck calculator to figure out your take-home pay as an hourly employee in Michigan.

The median household income is 54909 2017. 8 New or Improved Tax Credits and Breaks for Your 2020 Return. Local income tax rates top out at 240 in Detroit.

Your only income is a 50000 IRA distribution. Put Your Check in a Bank. Exactly what the title says.

So you wont get a tax withholding break from supplemental wages in Michigan. Michigan has a population of over 9 million 2019 and is widely known as the center of the United States automotive industry with the Big Three all headquartered in Detroit. From the chart above we can see that the first 19400 is taxed at 10 and the next 6200 is taxed at 12.

You would subtract 24400 from 50000 which equals 25600 in taxable income. The amount withheld per paycheck. Automatic deductions and filings direct deposits W-2s and 1099s.

The federal Fair Labor Standards Act FLSA and Michigans Payment of Wages and Fringe Benefits Act PWFBA allow employers to take legally authorized and voluntarily agreed upon deductions from your paycheck. Michigan income tax withholding. The average amount taken out is 15 or more for deductions including social security.

For 2022 the limit for 401 k plans is 20500. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis. For a single filer the first 9875 you earn is taxed at 10.

This will give you total taxes of. Why Gusto Payroll and more Payroll. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

A 2020 or later W4 is required for all new employees. The 10200 unemployment tax exemption only applies to 2020. Its important to note that there are limits to the pre-tax contribution amounts.

However you can still boost your paycheck through. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Amount taken out of an average biweekly paycheck.

W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. This differs from some states which tax supplemental wages at a different rate. Unlike most states Michigan uses a flat withholding tax rate of 425.

Federal income taxes are paid in tiers. Ive reviewed the previous emails and it states that I wanted 3 added. The income tax is a flat rate of 425.

Switch to Michigan salary calculator. Social Security and Medicare taxes. Michigan is a flat-tax state that levies a state income tax of 425.

If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. Amount taken out of an average biweekly paycheck. HR accidentally set my 401k contribution to 30 instead of 3.

For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. The IRS will automatically calculate this and give you a refund if necessary. Switch to Michigan hourly calculator.

In 2012 Michigans statewide flat tax rate fell from 435 to 425 although the city income taxes levied by 24 Michigan cities including Detroit were untouched. A total of 24 Michigan cities charge their own local income taxes on top of the state income tax rate.

Michigan Public Accountants Parents Who Took Advantage Of Child Tax Credit May See Smaller Refunds

Pay Stub Requirements By State Overview Chart Infographic

Michigan Payroll Tools Tax Rates And Resources Paycheckcity

Brighton Michigan Payroll Books Done Better

Michigan Payroll Tools Tax Rates And Resources Paycheckcity

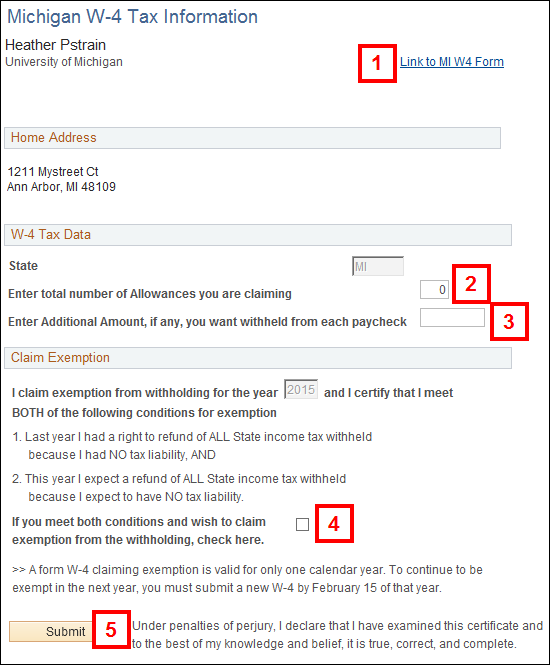

Understanding Your Pay Statement Office Of Human Resources

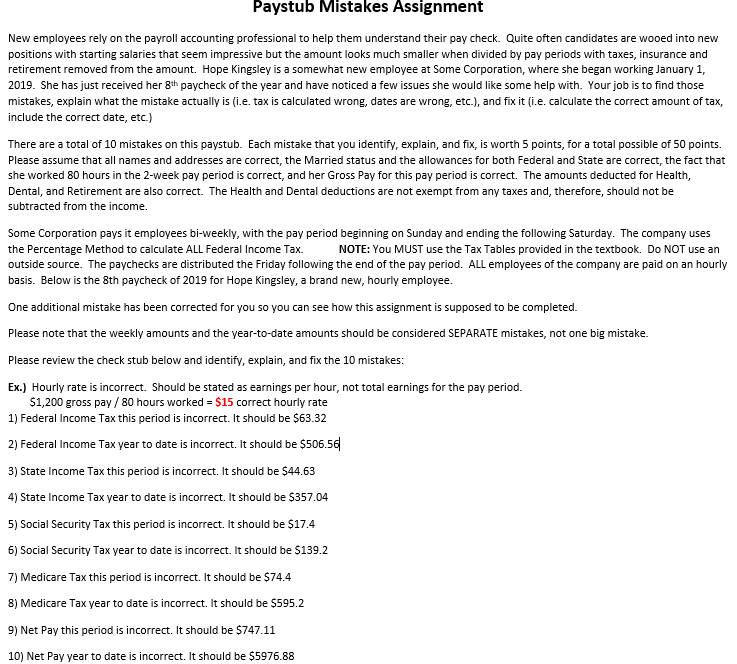

For The Federal And State Taxes The Retirement Is Chegg Com

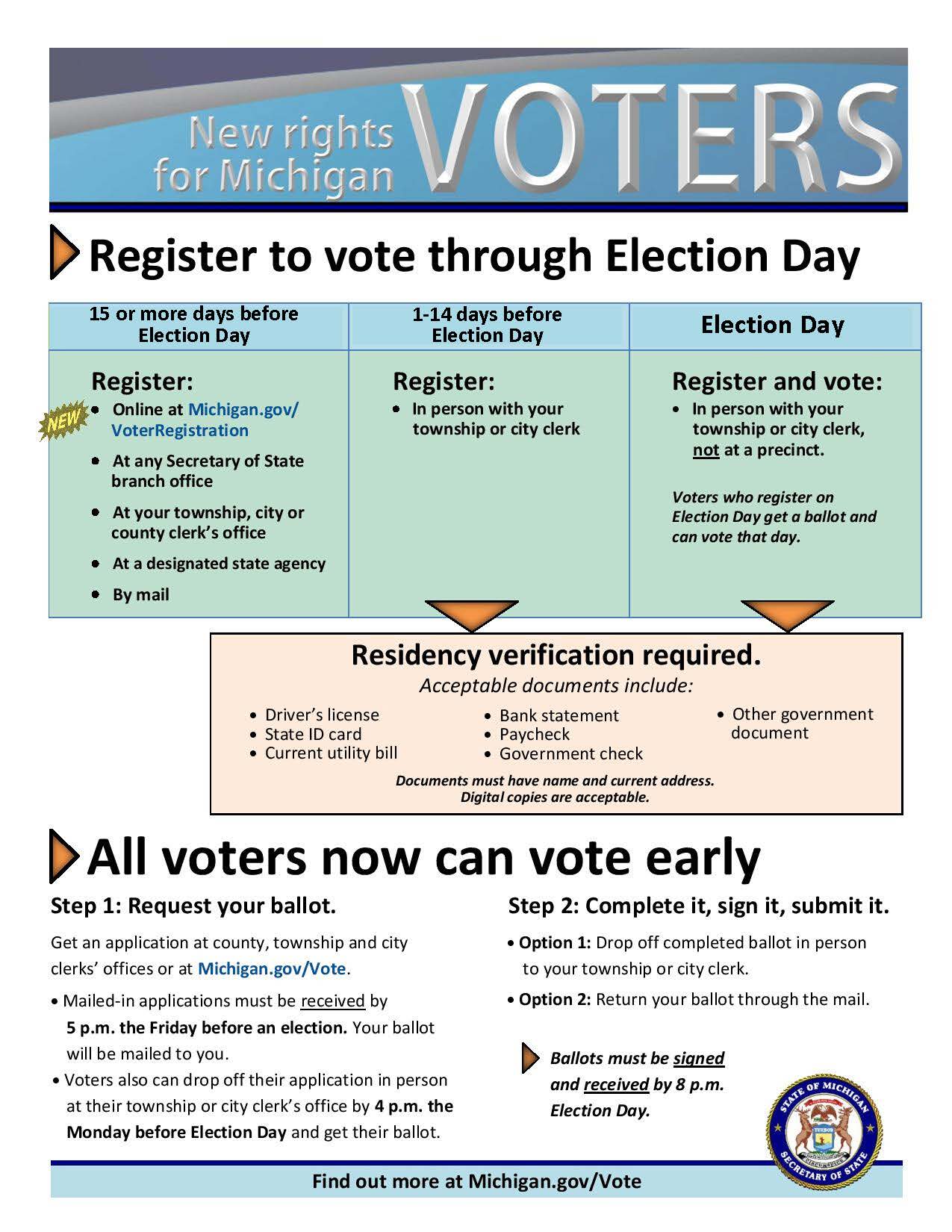

Help Michigan W 4 Tax Information

For The Federal And State Taxes The Retirement Is Chegg Com

Fleet Mechanic Salary In Detroit Mi Comparably

Michigan Salary Paycheck Calculator Paycheckcity

Michigan Paystub Generator Thepaystubs